We have stepped into the year 2016 with a bunch of new resolutions. Keeping the ever-rising medical costs in mind, one of your many resolutions ought to be safeguarding health of your family members and yourself. To acquire a financial protection from medical expenses you need to avail health insurance plan online. But, how will you understand which type of medical insurance cover is ideal for you and which medical insurance plans will meet your needs perfectly? To ease your quest to find the best health insurance plan in 2016 in India we have come up with a list of 5 best health insurance policies in all categories.

Find the right type of medical insurance plans that serves you best

The very first thing you need to do is understand what type of health insurance plan you need. Health covers can be classified in four categories. A health insurance provider in India offers the following type of health covers.

Individual health insurance plan: The individual mediclaim policy covers only the policyholder. The insured person is the only one to enjoy the benefits of the coverage on offer by the individual medical insurance plan.

Family floater health insurance plan: A family health plan provides coverage to multiple members of one family. You can pay just one premium for a specific sum assured in a year and protect the health of your whole family.

Senior citizen health insurance policy: Senior citizen health insurance plans are essential for those who have already retired and live on savings and pension. Any medical emergency can make a dent on their savings. So, a comprehensive senior citizen mediclaim insurance policy is a must for them.

Critical illness health insurance policy: Critical illness insurance cover protects you against severe illnesses like cancer, stroke. The policy covers massive medical costs and also provides lump sum compensation.

You have to choose any one the above-mentioned categories. Regardless of which type of health insurance plan you opt for here is a list of top health insurance policies from all categories. Let’s start with individual medical insurance policies.

Individual Health Insurance Plan:

If you think an individual health plan will serve your purpose best, you can select any health cover from the table below. The table reflects best individual health insurance policies in India in terms of premium and incurred claim ratio. The premiums are for a 35 year old person who wants coverage of Rs. 5 lacs sum insured. And, incurred claim ratio is the ratio of claims incurred by insurance company to the premiums earned by insurance company.

Conclusion

In essence, when it comes to protecting your and your family’s health you can avail any of the above-mentioned health insurance plans online for complete protection and peace of mind.

In this blog, I have discussed the best Mediclaim insurance online plans that fared well in 2015 and are expected to rock the year of 2016 as well. The compilation of the best health insurance plans in India will hopefully serve you as a useful guide so that you can select a good health insurance company and choose the best health insurance plans in India.

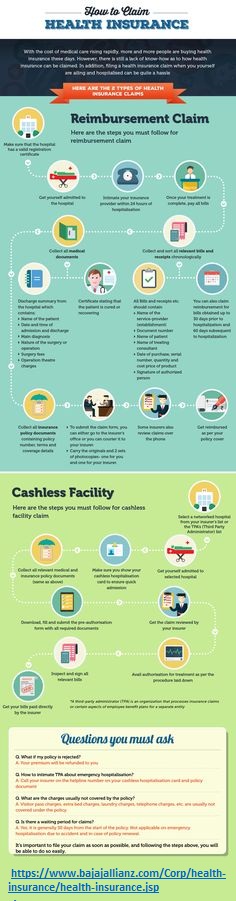

Medical costs and the complexity of diseases keep increasing by the day. A minor surgery can cost you anywhere between Rs 30,000 and Rs 60,000, while a cardiac treatment can cost you Rs 5 lakh, depending on the city and hospital you choose. One way to handle this rising cost is by taking a medical insurance policy in your name. In India, there are more than 25 companies offering various medical insurance policies. However, most of these policies are complex in nature and one plan never fits all. Hence, it is very important to note that you have to understand your individual needs in order to choose the right insurance plan. Here are a few points that will help you do this.

Medical costs and the complexity of diseases keep increasing by the day. A minor surgery can cost you anywhere between Rs 30,000 and Rs 60,000, while a cardiac treatment can cost you Rs 5 lakh, depending on the city and hospital you choose. One way to handle this rising cost is by taking a medical insurance policy in your name. In India, there are more than 25 companies offering various medical insurance policies. However, most of these policies are complex in nature and one plan never fits all. Hence, it is very important to note that you have to understand your individual needs in order to choose the right insurance plan. Here are a few points that will help you do this. Let’s face it. Most of us are “deal hunters”. We want the maximum “juice” from a product/service in the minimum price. No wonder the big branded stores, in that flashy mall are full with the so called “end-of-season dhamaka sale”

Let’s face it. Most of us are “deal hunters”. We want the maximum “juice” from a product/service in the minimum price. No wonder the big branded stores, in that flashy mall are full with the so called “end-of-season dhamaka sale”