Monthly Archives: August 2016

Tips To Get Best Health Insurance

What a wonderful gift life is? How beautiful it seems when we wake up every morning. It feels quite fascinating, when we open our eyes and admire the beauty of nature around india. However, the same life doesn’t looks so adorable, when we are not well. Imagine that, one day we open our eyes, sick and trashed from inside due to our bad heath. The charm of life turns into rush and stress of running to the hospital. Reaching to the hospital also goes in vein, because the estimated cost of the treatment that doctor quotes, is way out of your budget. What shall be done to get the charm of our life back?

Most of the time, people fail to understand the importance of such a solution, which can be their escape plan from a situation like this. The key to escape plan is known as Health Insurance. For the people who are unaware with the term, here’s a short description for the same;

“A health insurance is an insurance coverage that covers the cost of an insured personal’s medical and surgical expenses.”

Why to be so careless? Why to wait for the catastrophe to strike first, when we can be prepared for it. We have internet with us today, where we can get affordable health insurance online. Then, why it so that we are still not insured?

There are hundreds and thousands of health care insurance companies in the india, but how to find out which company shall serve your purpose optimally? Well, here are some points that might help you in determining the right insurance company.

Utility :-> Before choosing the Health Insurance Company or insurance policy, make sure that what shall be the use and utilization of that policy. Whether, the firm you are about to choose, is capable enough to give the coverage you are looking for. It is very important for us to confirm the utilization of any policy before we pick one.

Awareness :-> We all are very much known to the fact that, medical and surgical expenses are touching the sky today. It is very important to have some or the other health coverage, so that any financial downfall can be avoided and there shall no hindrance in the treatment of the patient. Do ask the Health Care Insurance Companies that what type coverage shall be provided by them? What are the health issues that shall be covered by these companies? What are the additional benefits that would be allowed by the insurance companies?

Sum Assured :-> Before we talk about the sum assured by the insurance companies? We shall first know that what actually this term means? Well, the maximum amount that can be reimbursed by any Health Care Insurance Company to a client is known as “SUM ASSURED”. Well, before you choose an insurance firm to purchase its policy, ensure that what shall be sum assured you shall be getting at insurance coverage.

[Source: http://hbgquote.blogspot.in/2016/02/tips-to-get-best-health-insurance.html%5D

Making Health Insurance Illegal- Imagine the Possibilities

You know how you solve the health care issue? Make all subsidized health care illegal, make all insurance based health care illegal. Enforce self pay healthcare for everyone. Doctors would now be competing against each other for clients. Prices would reduce, and you would have people more focused on staying healthy and eating correctly and exercising. Every time insurance gets involved, it completely screws things up.

I found that comment on ZH- months ago.

Think of the possibilities. We wouldn’t just eliminate the middleman- we’d eliminate an entire blood sucking industry that wastes 1/3rd of every health care dollar on administrative costs.

We all pay our own way- what a novel idea!

The same thing occurred at colleges and universities in the last 1/4 of the 20th century. The education industry found a middleman, bankers, and greased their way to the highest tuition increases in the history of education. Think about that. That system, just like the health care system, is irretrievably broken.

Middlemen, whether they are health insurance companies or bankers, fuel greed while lining their own pockets. They have no interest in slowing the system down or making it accountable or cost effective. In fact, the higher costs go- the more the middlemen make. They want costs to escalate. They are not bearing the costs directly and thus the higher costs go- the more money they scrape off the top.

Until the systems break. Of course the consumer goes first. Then the system does. The tapeworms always go last, at some point after the host dies.

Wouldn’t you love to hit the reset button on those two industries? I can’t even begin to imagine the possibilities.

[Source: https://health-insurance-plan.quora.com/Making-Health-Insurance-Illegal-Imagine-the-Possibilities]

How to Buy Small Business Health Insurance

One of the key components of running a successful small business is workforce retention. As an employer, when you find good people who are willing to work hard and help you achieve your goals of success, you want to give them an incentive to continue working for your company. Offering health insurance benefits is a great extra that you can provide for your employees to encourage them to stick with you for the long haul.

Unfortunately, buying health insurance for your small business can feel a bit overwhelming, especially with the high volume of information saturating the Internet. You want to make sure that you choose a plan and provider that is going to supply the kind of coverage your staff needs to live healthy lives. Here are a few steps to follow that will guide you in purchasing the best health insurance plan for your company, while avoiding the headaches of sifting through mountains of information online.

Assess Your Needs

When you start shopping for health insurance you have to assess your needs first, as this will help clarify what type of policy you and your employees need. One of the first questions to ask is who the plan will be covering. Call a meeting with your staff to find out their current health insurance situation. Ask if anyone has coverage under their spouse or through another family member. It is important to know how many people and their families will need to be covered, as this will decide the type of plan you choose and will have a major impact on the overall cost of the coverage.

Group health insurance, which is the type of insurance used by small businesses, is usually regulated by state law. It is important to keep in mind that most states will require an employer who provides health insurance for its employees to pay at least 50 percent of the monthly premium. Remember that percentage when shopping around for a quote. If you find a plan below your budget that provides great quality care, you may want to consider chipping in a bit more than the minimum 50 percent as an extra incentive.

You will also need to find out whether your employees want to pay more up front when they are well and less when they are ill, or the other way around. This is a great conversation to have during the benefitis meeting mentioned earlier. Some plans have higher annual deductibles, but come with a smaller monthly premium, while others have a higher premium but lower deductible. Once you know where the majority of your employees stand, you will want to try and find a plan that has a good balance between the deductible and the premium.

Ask your team what kind of benefits are important to them, as this will also play a critical role in determining what policy you choose for your business. Federal laws will prohibit you from asking too many detailed questions about an individual’s private medical history, but you can still ask them if they want something that provides more coverage for prescription drugs, or if they are interested only in catastrophic health coverage. This would also be a good time to discuss whether or not your team is interested in add-ons like dental and vision care.

[Source: https://www.matrixia.com/buy-small-business-health-insurance/%5D

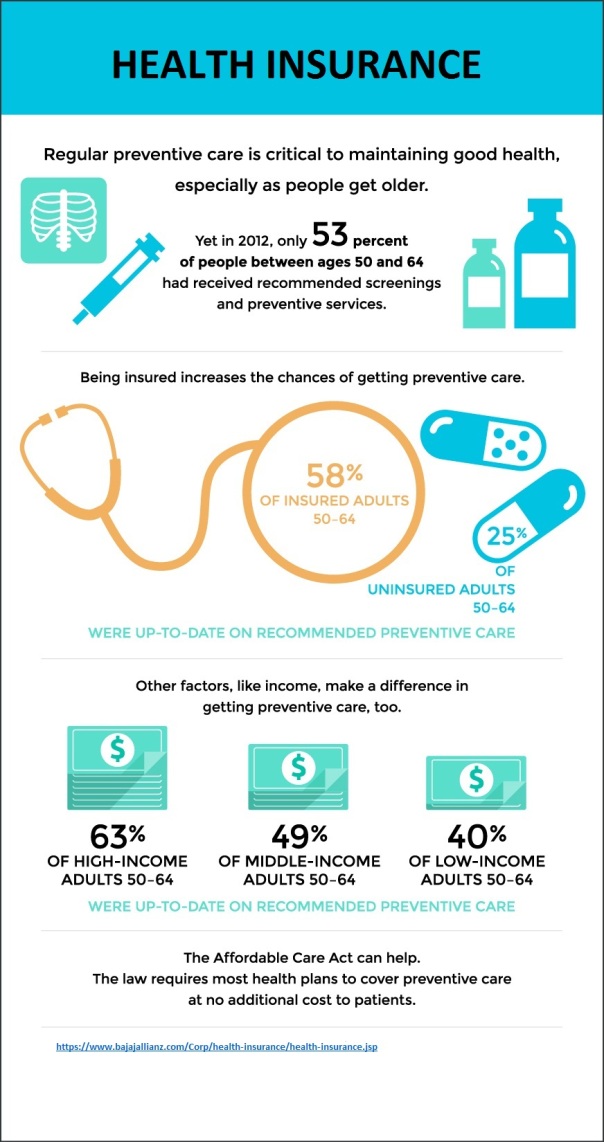

Health Insurance

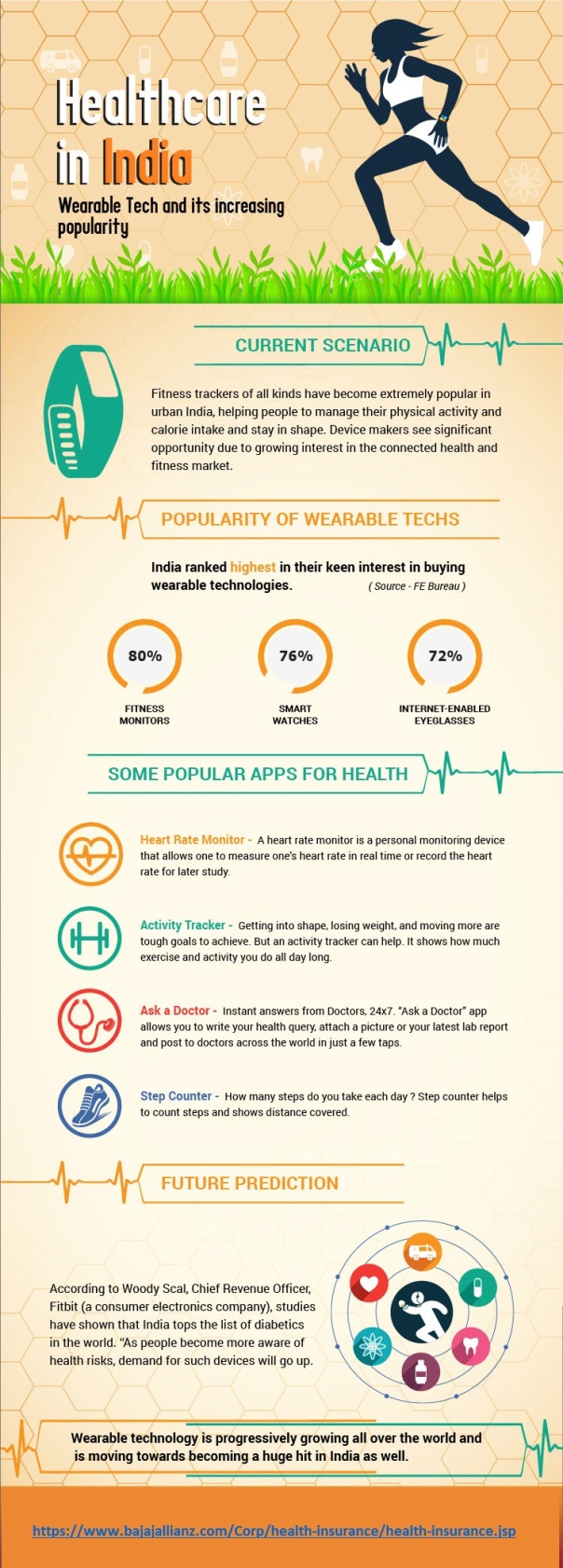

Healthcare in India Wearable Tech and its Increasing Popularity

Got a new Health Insurance Plan this year?

Here are five steps that can help smooth your transition to a new plan.

Every year, many Americans like you take the opportunity during Medicare’s Open Enrolment period to change insurance plans. Regardless of whether you are changing a Medicare Supplement, an Advantage Plan or a Part D Prescription Drug Plan, there are a few things you can do now to avoid problems now that your new insurance has gone into effect in 2016.

- If you are going from a Medicare Supplement to a Medicare Advantage Plan, make sure you have cancelled your supplement coverage. Your Supplement is not automatically cancelled when you switch to an Advantage Plan. Although some companies will cancel and make changes over the phone, others require a written request so give your Supplement Plan insurer a call and ask what they require.

- Cancel your automatic withdrawals for the old plan. I recommend you cancel your withdrawal with the insurance company and then follow up with a call to your financial institution to make sure the automatic withdrawal is cancelled.

- Tell your doctor that you have different insurance. If your doctor unknowingly files for reimbursement with the wrong insurance company, it will cause confusion and delays in payment. Let your doctors know about your new plan the first time you see them in the New Year.

- Check your Prescription Drug coverage to find out what pharmacies are the preferredpharmaciesof your new plan. If it’s a different pharmacy than the one you’ve been using, arrange to transfer your prescriptions now so they have your information on hand. You should also present your new health insurance Plan cards to your pharmacy before you need your next prescription. Don’t wait until you need a refill or have an emergency before you make this change.

- Determine whether your new plan has different requirements for prescriptions. Some plans may require a pre-authorization before your prescription will be filled. Take steps ahead of time to let your physician know what’s required by your new plan.

[Source: https://theseniorinsider.blogspot.in/2016/01/got-new-health-insurance-plan-this-year.html?%5D